If you want to explore your mortgage options, it is a good idea to speak to an independent mortgage broker who will be able to offer impartial advice. Therefore, it is always advisable to check with your mortgage provider before making any overpayments. Some lenders are flexible and allow overpayments, whereas others charge early repayment penalties. Making overpayments can allow you to repay your mortgage quickly. Repayment mortgages may be a good option for you if you want to ultimately own the property outright. Repayment mortgages are mortgages that require you to pay both the capital and the interest of a mortgage, which results in high monthly mortgage payments. At 5 interest, your payment would be 1582. However, as a trade-off, interest only mortgages do not provide the opportunity to own the property at the end of the mortgage. With a 15-year mortgage, your monthly payment on a 200000 mortgage at 3.5 jumps to 1430. Interest only mortgages are mortgages that only require you to pay the interest on a mortgage, which results in lower monthly mortgage payments than most other mortgages. Tracker mortgages’ interest rates are heavily dependent on the Bank of England’s base interest rate.

$200 000 MORTGAGE PAYMENT 15 YEARS FREE

Tracker mortgages are mortgages with interest rates that vary throughout the term. Free mortgage calculator to find monthly payment, total home ownership cost.

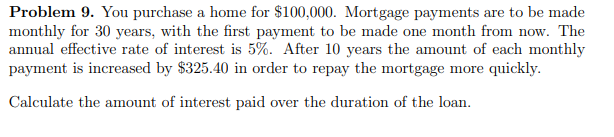

1 bonus in 5 years, subject to meeting the conditions of the mortgage. It should be noted that interest rates are liable to fluctuate over the years, and therefore a good interest rate today may not continue to be good for the duration of your fixed rate period. Use our mortgage calculator to calculate how much you can borrow or try our. Getting a fixed interest rate for a prolonged period allows you to know exactly how much you will pay each month. High street banks often offer fixed rate mortgages for 2,3,5 or 10 years.

Lenders will often request the following during an application: The more you put down, the lower your mortgage payment will be. Choose a 30-year fixed-rate term for the lowest possible payment, or a 15-year term if you want to save interest and pay off the balance faster with a higher monthly payment. Nowadays, lenders will focus more on the affordability of the mortgage. This is the number of years it’ll take to pay off your loan balance. Lenders have changed the way they review mortgage applications.

0 kommentar(er)

0 kommentar(er)